Domineering the Currency Trading Arena: A Forex Trader's Odyssey

In the fast-paced world of Forex trading, the path from an novice to the confident trader is packed with priceless lessons, challenges, and opportunities for growth. Many aspiring traders find themselves overwhelmed by the intricacies of the foreign exchange market, but understanding the core principles can pave the way for success. This article aims to shed light on key concepts, strategies, and insights that can help both beginners and seasoned traders navigate the dynamic landscape of Forex.

From grasping how the Forex market works in simple terms to becoming proficient in the intricacies of reading Forex charts, this journey encompasses a range of topics designed to enhance your trading skills. We will explore the importance of risk management, the psychology behind successful trades, and various trading strategies that can be adapted to suit your personal style. Whether https://www.forexcracked.com/forex-ea/ are interested in day trading, swing trading, or utilizing automated trading systems, our guide will provide the tools you need to craft a profitable Forex trading plan while avoiding common pitfalls.

Comprehending Foreign Exchange Market Fundamentals

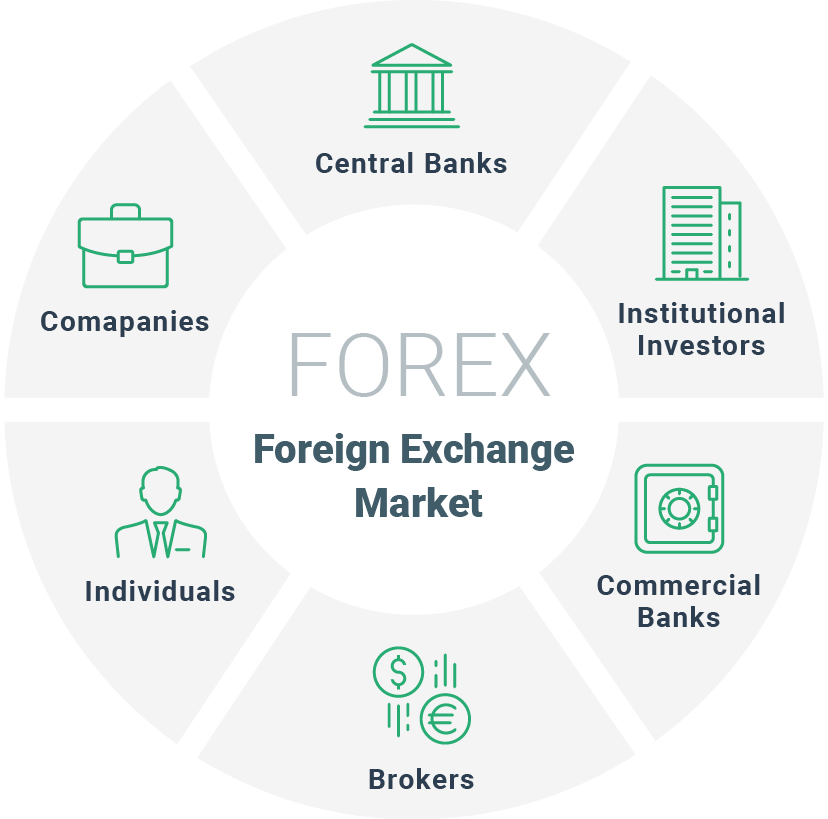

Forex currency trading, entails buying and trading foreign currencies with the aim of making a 收益 through variations in their exchange rates. In contrast to other investment markets, the Forex market operates 24 /7, five days a week, and is the biggest monetary market in the world, with daily trading volume surpassing six trillion dollars. Understanding the basic concepts of currency trading is important for anyone looking to participate in this active market.

To begin trading Forex, one must grasp key ideas such as currency pairs, which represent the worth of one currency relative to another. Major currency pairs include common options like the Euro against the US Dollar, while minor pairs often involve not as frequently traded currencies. Exotic pairs, on the flip side, feature one major currency and one of a developing economy. Knowledge of how these pairs fluctuate in response to economic indicators is crucial for traders looking to capitalize on price movements.

Leverage plays a significant role in Forex trading as it allows traders to control larger positions than their initial capital would normally allow. This can increase potential profits but also heightens the risk of significant losses. With the allure of high returns provided by leverage, it is vital for Forex traders to implement sound risk management strategies and understand their own risk tolerance before entering the market.

Effective Market Techniques

A effective Forex trader must harness several clearly laid out strategies to maneuver through the market efficiently. One popular approach is day trading, which entails making swift trades to capitalize on minor price fluctuations. Scalpers utilize tight spreads and need to develop a sharp sense of timing and self-control. On the flip side, swing trading offers a alternative perspective, enabling traders to hold positions for a few days or weeks, capturing more significant price movements. Knowing when to apply each strategy based on market situations is key to boosting profitability.

Another crucial aspect of trading strategies is the utilization of quantitative indicators. Instruments like moving averages, Relative Strength Index (RSI), and Bollinger Bands can deliver indications into potential price fluctuations and help traders make informed choices. By evaluating historical price trends and market trends, traders can recognize critical support and resistance points, enhancing their ability to decide when to initiate or exit a trade. Pairing these indicators with a robust trading plan often leads to better performance.

Risk management is equally essential in crafting effective trading strategies. Effective traders implement stop loss and take profit orders to safeguard their investments and ensure that losses are limited. Additionally, comprehending the risk-to-reward ratio allows them to assess whether a trade is worth taking based on its potential return relative to the risk involved. By integrating these elements into their trading practices, Forex traders position themselves for long-term success and success in an often volatile market.

Managing Threats and Feelings

In the domain of Forex trading, handling risk is as vital as creating efficient trading strategies. Every trader should set up a risk management plan that comprises setting proper stop loss and take profit orders. By defining how much capital one is ready to risk on each trade, traders can shield themselves from unexpected market movements. Including risk-to-reward ratios is also essential; it helps traders understand the potential gain versus the loss they're ready to accept, which can significantly affect long-term profitability.

Managing emotions is another critical aspect of successful trading. The psychological challenges of Forex can result in poor decision-making, thus negatively impacting trades. Traders must cultivate techniques to manage emotions, such as fear, greed, and impatience. Maintaining a trading journal can be helpful, as it allows traders to reflect on their decisions and emotional responses, encouraging self-awareness. Practicing mindfulness and exercising discipline can help traders adhere to their trading plans even during unstable market conditions.

Harmonizing risk management with emotional discipline creates a foundation for sustainable trading success. Traders should not only focus on strategies and market analysis but also work on their psychological resilience. Realizing that losses are an unavoidable part of trading and figuring out how to manage those feelings without letting them dictate actions will ultimately help traders succeed in the Forex market. By committing to a disciplined approach and upholding a clear mindset, traders can navigate the emotional rollercoaster of Forex trading more effectively.